Education is the key to success in business but I’m not just talking about your college or university; I’m talking about self-education.

Understanding the finances behind your business can help you increase your profits, cut back on expenses, and operate more smoothly. Contribution margin ratio is one of these financial terms that sounds more complicated than it is. In this article, we’ll cover how to calculate it, what it means, and how to improve it.

What Is the Contribution Margin Ratio?

A contribution margin ratio is the difference between sales and variable costs within a company. For example, if an ecommerce store sells t-shirts for $20 and the variable cost of producing the t-shirt is $10, then the contribution margin ratio per unit is $10.

To learn how to get the contribution margin ratio, you subtract the variable costs of producing a product or service from the overall sale price of the product or service.

The difference will then get used for fixed costs, like rent and insurance.

It’s important to understand the contribution margin ratio formula because it helps identify changes in your margins and determine the source of the problem.

Here’s another example: let’s say you’re the manager of an SEO agency, and you charge your clients $2,000 per month. Typically, you operate at a 50 percent margin, which means you spend approximately $1,000 each month on variable expenses and take in a $1,000 margin to cover fixed costs. The remainder would then serve as your net profit.

One month you notice you only have a $500 margin, so you start investigating. Turns out one of the agencies you outsource to overseas increased their rates, and it’s cutting into your bottom line. You can now handle the situation by either increasing your rates, renegotiating your contract with your vendor, or shopping around for someone more affordable.

Without watching the set contribution margin each month, you couldn’t identify these types of issues.

Fixed Costs Vs. Variable Costs

Part of understanding how to calculate the contribution margin ratio involves fixed costs vs. variable costs. You need to understand the differences and similarities between these two sets of expenses.

Fixed costs refer to expenses that remain the same month after month and do not change, regardless of your volume or production. Some examples of fixed costs are:

- rent or lease

- interest charges

- insurance

These are predictable costs, and that’s why we use our margin to pay fixed costs because we know how much they’re going to cost each month and how much money we’ll need to pay them and still have profit left over.

On the other hand, variable costs change each month and vary based on the level of production.

For example, if your company produces 100 t-shirts one month, and 200 t-shirts the next month, there are added costs associated with the extra 100 products. You’ll have additional materials and labor. If you understand your contribution margin ratio, that shouldn’t matter because you’re bringing in a certain amount of profit from each product you produce.

This impacts how companies scale and profit. While variable costs may increase, fixed costs stay the same unless you invest in a larger facility or add new employees, which may increase insurance and benefits costs.

Variable costs help companies identify issues in their system. If you find your margin is way down on a specific t-shirt, you can research to figure out what happened. Maybe the cost of purchasing the shirt went up, which reduced your margin from 50 percent to only 25 percent.

Whatever it is, understanding how variable costs change can help you price products and adjust as the market fluctuates.

How to Calculate Your Contribution Margin Ratio

To calculate your contribution margin ratio, use the following formula:

The simplest way to break it down is to look at it by individual product or service. Using the ecommerce example again, if your company sells custom rugs for $50 and it costs you $30 to source the materials and produce the rug, your margin is $20.

In this same scenario, your margin would be 40 percent because you’re taking in a 40 percent margin for every piece of product you produce.

The same applies to services.

If you run a web design company, you may not have costs associated with goods, but you’ll have labor and potentially variable costs in the tools and applications you use. Some applications may have fixed costs, while others might charge based on how you use them.

Let’s say you charge $1,000 for a website, and it costs you $500 to produce it. Your contribution margin would be $500, or 50 percent.

Of course, we all want a contribution margin as close to 100 percent as possible, but that’s not likely. Most businesses operate at a less than 50 percent margin, but it won’t be the case on every product or service.

Some products may yield a 75 percent margin, while others only bring in 10 percent. In many cases, those 10 percent margin products are lead magnets, while the larger margin item is an upsell.

What’s most important is understanding how to calculate this and use it to maximize your profits.

Why Should You Use the Contribution Margin Ratio?

Why is contribution margin ratio important? Even small businesses need to know their ratio to:

- identify changes in variable costs

- determine how much you can pay yourself

- increase or reduce the cost of goods and services

- make labor changes based on volume

- ensure you have enough to pay fixed costs each month

The list could go on, but it’s all part of being a business owner. Understanding how to identify issues with your margin isn’t always easy, but we can help you if you’re struggling.

How to Improve Your Contribution Margin Ratio

Now let’s talk about some actionable steps you can take to improve your margin to increase your costs or cut more profit for yourself.

Increase Customer Retention

Doing everything you can to retain customers will help improve your margins. Spending a lot of money on sales each month will cut into your bottom line, especially if you’re not bringing in new customers as a result of your efforts.

As your business grows, you can determine how much it will cost you to acquire a new customer. This will happen when your business develops a duplicatable system for driving in new business.

Improving your onboarding process, providing better customer service, and offering incentives to long-term customers can all help improve retention.

Get Creative With Reducing Expenses

If expenses for producing products or paying for services are cutting into your margins, it might be time to look deeper. Take a look at how much it costs to produce your product, and figure out ways to reduce the cost without lowering the quality.

Shopping around for vendors might be a good place to start. Someone else may offer the same product at a lower price. You may also be able to reduce your cost by purchasing more upfront if it’s a product that sells well.

The same goes for service businesses. Perhaps your labor is too high on a specific service. It could be due to poor practices, new hires, or bad training procedures. You’ll want to look into this and identify the bottleneck running up your labor. Automating parts of your process might also help.

Consider Price Changes

I am not saying to raise your prices across the board. Instead, identify areas where you could raise your prices. During the investigation, figure out ways to offset the additional cost in other areas.

For example, you might have to raise your shipping fee because the cost has gone up, but you can use a different vendor to source a product, thus reducing the overall price of your product. This will ensure you don’t upset customers and while increasing your margin.

In some cases, you need to charge what the market will bear. An across-the-board price increase may be necessary if you haven’t raised your prices in a while, a quick email or call to your best customers can help remedy the situation. If you’re in the B2B market, most customers will understand.

Keep in mind that everything has a “trickle-down” effect. You’re raising your prices because the cost of producing your goods has gone up. Chances are, your customers will raise their prices as a result.

Increase Sales

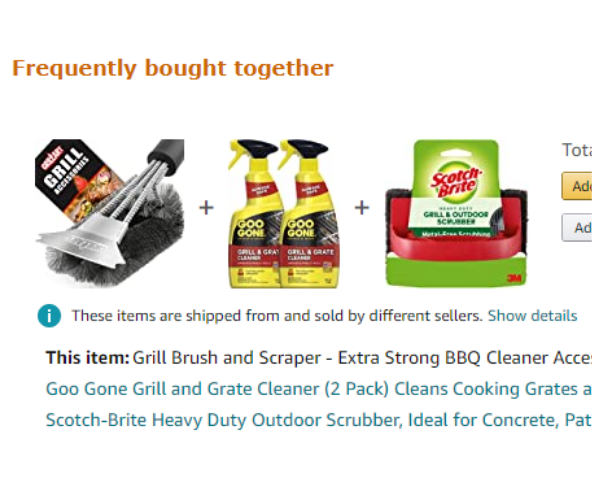

Increasing sales is easier said than done, but there are plenty of ways to make it happen. One way is to focus on upsells or add-ons to products you’re already selling.

Amazon does a great job with this by recommending products relevant to current purchase or related to items customers have browsed in the past.

For example, if you sell grill accessories, you might want to add certain items such as grill brushes or cleaning materials.

Another great way to increase sales is by bundling items together. While it might be great to sell all those grill accessories separately, offering them in a bundle could make things simpler for the customer and motivate them to purchase everything all at once. It could also help you save on shipping costs.

You can also look internally at your sales and marketing strategy. What can you do to improve? Does your team need more training, do they need a refresher, or do they simply need a little more motivation?

Sometimes it’s not simply one action, but rather something you need to do collectively as a team to increase your sales. For example, focusing your sales team on attracting long-term, high-profit customers or spending more time qualifying leads.

Reduce Shipping Costs

Shipping costs add up quickly, and this variable expense will cut into your margin if you aren’t paying attention to the fluctuations in shipping. I mentioned bundling is a great way to save money, and that’s one reason why most ecommerce stores and businesses won’t charge for shipping if you spend $25 or $50.

Requiring customers to purchase a certain number of products to get free shipping is a great way to take the load off your shoulders. Now you’ll know that shipping costs are covered, no matter what. If they choose not to purchase over the threshold, then they’re responsible for paying for shipping.

Sometimes this isn’t feasible because your products are very large or heavy. In this case, you need to cover the cost of shipping or at least factor it into your overall price.

Looking at different vendors or methods of shipping might be your only option.

Planning and organization are key when it comes to shipping. If you’re constantly falling behind on your production times and forced to pay for overnight or next-day packages, that will cut into your margin. Extending your delivery time, charging for faster delivery, or speeding up production could save you a bundle.

Conclusion

Understanding how to calculate your contribution margin ratio is important, but leveraging that information is key to long-term business growth. The goal of every business owner is to have as much as possible left over after all expenses are paid; that’s obvious.

Not every business owner knows how to get there, though. Self-education opens the door to success. Educating yourself on the economics of your business sets you up for increased profits and a more successful business.

The backbone of any good business is a solid marketing plan, and if you need help with that we have you covered. Reach out to our team of digital marketing experts and we can get help you get started.

What is your contribution margin ratio, and how do you ensure that you hit it each month?

Recent Comments